New Human Capital Factor Ratings Validate the Financial Impact of Enterprise Engagement

Key HCF Finding: Alpha Requires a Holistic Approach

The Enterprise Engagement Framework

Background on EEA Engaged Company Stock Index and Curriculum

Click here for links to RRN Preferred Solution Providers.

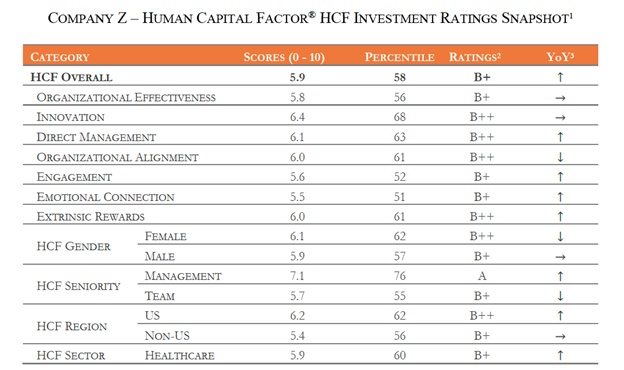

J.P. Morgan Securities' global quantitative and derivatives strategy team has independently verified the potential for enhanced future equity value performance through the implementation of a strategic and holistic approach to people management. The analysis finds the potential for an alpha of about 4% in terms of future equity value by organizations that have high Human Capital Factor® ratings, a framework developed by Pennsylvania-based Irrational Capital. See ESM: The Holy Grail of Investing and HR? New Solution Connects Human Capital to Return on Equity.

The Human Capital Factor developed by Pennsylvania-based Irrational Capital closely aligns with the framework developed by the Enterprise Engagement Alliance in 2009.

With no financial stake in Irrational Capital, the J.P. Morgan Securities quantitative analysis team

With no financial stake in Irrational Capital, the J.P. Morgan Securities quantitative analysis teamextensively studied the Human Capital Factor ratings developed by Irrational Capital to help investors and investment managers enhance equity valuations through better management of people. Khuram Chaudhry, Managing Director and Head of European quantitative strategy, wrote earlier this year in Pensions & Investors. “Over the past three years, the global quantitative and derivatives strategy team at J.P. Morgan Securities has analyzed the data behind the Human Capital Factor (or HCF), an approach developed by investment research firm Irrational Capital that seeks to quantify the link between human capital management and [future] equity performance using a combination of public and private data sources.”

In the Pensions and Investors article, Chaudhry explains, “The proprietary pillar of the data is constructed from the analysis of 2.6 million individual responses to human resources surveys, comprising more than 71 million unique survey data points covering over 1,300 publicly traded US companies and spanning the last 15 years. This dataset includes ratings on the usual and easy-to-measure topics such as compensation, benefits, and training, but adds a wide range of far more important and difficult-to-measure characteristics of the employee-employer relationship. The HCF can deeply evaluate the human side of the organization, and tangibly measure levels of appreciation, pride and trust and the relationship with one's manager, the sense of psychological safety and more within the organization.”

Key HCF Finding: Alpha Requires a Holistic Approach

Here are the factors that contribute to future equity value tracked by the Irrational Capital ratings, which can generate an alpha of about 4% based on independently verified calculations, including the actual results of multiple ETFs (exchange-traded funds.)

Intrinsic Factors (Those elements that are deeply personal, emotional and human and difficult to count.)

- Management (Direct and Senior): mutual respect, confidence, assistance, personal contribution, empathy, personal development.

- Emotional Connection: expectation, confidence, appreciation, purpose/meaning; psychological safety.

- Engagement: Retention, pride, etc.

- Innovation: Diversity of perspective; new ideas.

- Organizational Alignment: harmonized values, strategic direction, open communication.

- Organizational Effectiveness: inter-departmental cooperation, quality, respect, potential, psychological safety, positive business outlook, positive culture outlook.

Extrinsic Factors (Those elements which are relatively easy to count)

- The basics: Compensation (level), benefits (level), training hours, physical environment and more.

Click here for a sample HCF report for a fictional company, which includes recommendations based on the findings.

The Enterprise Engagement Framework

Here is how the HCF rating compares with the implementation framework developed by the Enterprise Engagement Alliance starting in 2009 to help organizations enhance their performance through people. The Human Capital Factor analysis independently validates that the effective implementation of these strategies and tactics can have a concrete impact on the future equity value of an organization.

- Clear sense of mission – What the organization stands for

- Clear goals – Where do we want this relationship to go?

- Emotional bonding – A sense of community and camaraderie

- Capability – Do people have the resources and knowledge to do what is asked of them?

- Fun – A sense of humor and good-naturedness

- Support – A sense of being valued and that someone human is overseeing the process

- Task value – A sense that what I’m doing has purpose

- Feedback – Meaningful suggestions on how to improve.

Here are the implementation initiatives outlined in the tactics drawn from ISO 30414 and ISO10018 to align with international standards.

- Leadership

- Diversity, Equity, Inclusion

- Occupational Health and Safety

- Organizational Culture

- Productivity

- Skills and Capabilities

- Recruitment, Mobility, Turnover

- Customer Engagement

- Supply Chain and Channel Partners

- Community Engagement

Click here for a syllabus of the Enterprise Engagement Alliance curriculum.

The implications.The ability to objectively rate key factors validated to contribute to future value creation opens up enormous opportunities for human resources and the organizations that support the profession. The organizations that strategically and systematically address the above issues have a good chance of increasing future equity value in a way that can be transparently measured and rated on an ongoing basis as well as tracked against benchmarks. Organizations that receive high ratings can use the HCF as a recruiting tool for investors, customers, employees, distribution and supply chain partners, and communities.

Background on EEA Engaged Company Stock Index and Curriculum

To prove the benefits of an enterprise approach to engagement, the Enterprise Engagement Alliance in 2012 and its sponsor EGR International funded a six-year mock ETF (exchange-traded fund) created by the analytics firm McBassi Inc. that outperformed the S&P 500 by over 38%. The companies were selected on about a dozen public metrics of customer, employee and community engagement, including ACSI (American Customer Satisfaction Index) and Glassdoor employee ratings.

The enterprise engagement theory upon which the stock index and Enterprise Engagement Alliance curriculum was developed was the result of research conducted by the Forum for People Performance Management and Measurement at the Medill School of Journalism and Integrated Marketing Communications at Northwestern University; the 2001 study, “Incentives, Motivation and Workplace Performance” by professors at the University of Southern California for the Incentive Research Foundation, and Gallup's human sigma research and research.

For more information on the Enterprise Engagement Alliance curriculum program, click here.

Enterprise Engagement Alliance Services

Celebrating our 15th year, the Enterprise Engagement Alliance helps organizations enhance performance through:

1. Information and marketing opportunities on stakeholder management and total rewards:

ESM Weekly on stakeholder management since 2009.

RRN Weekly on total rewards since 1996.

EEA YouTube channel on enterprise engagement, human capital, and total rewards since 2020.

2. Learning: Purpose Leadership and Stakeholder Management Academy to enhance future equity value for your  organization.

organization.

3. Books on implementation: Enterprise Engagement for CEOs and Enterprise Engagement: The Roadmap.

4. Advisory services and research: Strategic guidance, learning and certification on stakeholder management, measurement, metrics, and corporate sustainability reporting.

5. Permission-based targeted business development to identify and build relationships with the people most likely to buy.

Contact: Bruce Bolger at TheICEE.org; 914-591-7600, ext. 230.