IRF 2024 Outlook Is Positive for Merchandise, Gift Cards, and Event Gifting

Optimism Remains, With More Caution in US

Summary of Key Insights

Click here for links to RRN Preferred Solution Providers.

Merchandise, gift card, and event gifting budgets are generally expected to increase in 2024 and the pace of program cancelation continues to fall, though corporate respondents are more bullish than incentive and recognition companies, according to this Incentive Research Foundation survey of 193 North Americans and 209 Europeans from the United Kingdom, Italy, Spain, France, Sweden, and Germany. Nearly three quarters of the respondents were corporate program owners, 16% third party agencies, and 10% industry suppliers. All respondents verified that they are responsible for non-cash incentive programs including merchandise, gift card, and event gifting programs.

For the complete study, click here.

Optimism Remains, With More Caution in US

While survey respondents remain generally positive, ongoing uncertainty in economic and labor markets have eroded some of the optimism of the incentive and recognition companies surveyed. After a two-year rebound in optimism following the pandemic, more than half (58%) now feel the US economic outlook is strong, down slightly from 63% last year; 80% of respondents expect their companies to show strong financial performance in 2024, down from 88% in the 2023 Industry Outlook.

The level of North American US recognition and incentive company confidence is “a few percentage points lower on their company’s strong financial outlook (76% for third party vs. 81% for corporate) but more markedly cautious in their outlook for the US economy (50% vs. 62%).”

European program owners and third parties are generally confident of their company’s financial performance in 2024, with 84% expecting strong performance. Unlike in North America, European respondents have indicated smaller but steady increases in their outlooks over the last three years (78% in 2021, 82% in 2022, and 84% this year).

The study suggests that “lingering economic uncertainty, rising costs, a continued tight labor market, and a looming presidential election combine to yield the most measured net optimism score the IRF has reported for North America in over a decade.”

Summary of Key Insights

Regulations. European stakeholders say they are more affected by specific aspects of the regulatory environment than their North American peers.

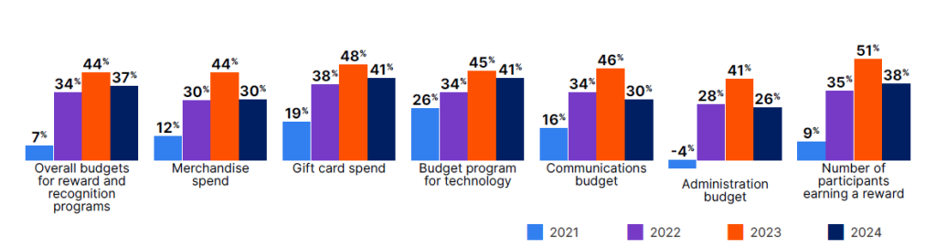

Budgets. Over two-thirds of North American respondents report their budgets will increase going into 2024. “Increases are expected across all categories, with gift card and program technology seeing the most anticipated growth by 41% of respondents, driven partially by a higher number of participants expected to earn a reward for 38% of respondents. Corporate program owners and third parties generally agree about these increases, with some exceptions. Third parties are more likely than corporate program owners to forecast increased spending on program technology (53% third party to 39% corporate) and communication (37% to 28%) but less likely to expect increases to the overall budget (30% third party to 40% corporate), merchandise (20% to 31%), or program administration spend (17% to 29%).”

North America Anticipated Net Change in Budgets for 2024

Following a considerable jump between 2021 and 2022, per-person spend has increased only slightly, from $1,060 in 2022 to $1,090 in 2023. One quarter of respondents (24%) budget between $101 and $200 per person, with another 20% budgeting between $251 and $500 per person.

Outlook in Europe. Among European program owners and third parties, 48% see increased spending for reward and recognition this coming year. European industry respondents anticipate increases for program technology (56%), gift card spending (53%), communications (53%), and merchandise (51%). Just over half (52%) of European respondents expect an increase in the number of award earners in 2024. Corporate program owners are more likely to forecast increases in every category compared to third parties, with the most notable expectation gap in gift card spend (net 45% of corporate vs 15% of third party). European reward and recognition professionals reported an average spend of €909 per person in 2023, up significantly from €650 in 2022. This is due to an increase in programs with average per-person spend over €500, the report states.

More third-party sourcing seen. Following a considerable jump in 2022, North American respondents continue to expect a net increase in both involvement (27%) and fees (32%) for third parties, according to the report. For North American and European corporate program owners alike, the most prevalent direct relationships are with gift card brands (64% North America, 62% Europe) or merchandise brands (52% North American, 56% European). “With a relationship reported by just over a third of respondents in both North America and Europe, incentive houses, marketing agencies, and consulting firms have the most opportunity to increase their footprint with program owners.”

Merchandise gains anticipated. North American and European stakeholders alike expect continued increases in merchandise rewards in 2024, with North American respondents slightly more positive. In North America, corporate program owners are more likely than third parties to expect increased prevalence of merchandise rewards, but both groups see gains. In Europe, 31% of corporate respondents expect an increase while third parties are more likely to expect a decrease. The average value per person spend on merchandise programs’ for reward/recognition is $177 in North America and €174 in Europe. The survey indicates that third parties in North America spend significantly more on average than corporate program owners ($221 third party vs. $169 corporate). In Europe, the reverse is true, with corporate respondents outspending third parties (€180 corporate vs. €149 third party.)

In North America, the most prevalent reward selections are: logoed brand-name merchandise (65%); electronics (64%); clothing/apparel (63%), and food gifts (61%). All merchandise categories in North America show an increase year-over-year with the exception of plaques/trophies (-22% vs. prior year), local handmade goods or crafts (-19% vs. prior year), flowers (-6% vs. prior year), housewares, (-8% vs. prior year), and luggage (-19% vs. prior year).

In Europe, the prevalent merchandise rewards include food gifts (61%), electronics (54%), logo brand-name merchandise (48%), and office accessories (43%). Unlike in North America, the prevalence of specific merchandise gifts has shown minimal changes from the previous year, with exceptions noted in food gifts (+20% vs. prior year), logo brand-name merchandise (+9% vs. prior year), and clothing/apparel (-9% vs. prior year). Europe, in contrast to North America, generally exhibits lower prevalence of merchandise gifts across various categories, particularly in logo brand-name merchandise, plaques/trophies, and clothing/apparel.

Gift card spending trending up. North American respondents anticipate a strong increase in 2024 for gift cards, with 52% of respondents anticipating an increase, and only 10% predicting a decrease in gift card budgets. In North America, third parties expect to see greater net increases in gift card rewards when compared to corporate program owners (50% third party vs. 40% corporate).

The survey finds that Europeans generally plan to increase their gift card rewards in 2024 with 51% expecting gift card growth and only 14% expecting a decrease. The average gift card denomination is $152 in North America and €161 Europe. In 2023, North America witnessed a rise in the utilization of brand-specific gift cards (+13% vs. prior year), while open-loop cards, restricted cards, and gift card vouchers showed negligible differences compared to the reports from prior year.

In Europe, there is minimal variation in the types of gift cards used, with gift card vouchers experiencing the most notable change (+6%) from 2022 to 2023. Europeans demonstrated a higher preference opting for gift card vouchers compared to North Americans (72% Europe, 44% North America). In contrast, Europeans were less inclined to use open-loop or brand-specific cards compared to their North American counterparts.

In North America, nearly all brand-specific gift card categories continue to experience participation growth compared to 2022, with minor exceptions observed in sunglasses (-6% vs. prior year) and accessories and jewelry (-1% vs. prior year). The utilization of gift cards is on the rise, both in terms of volume and the variety of options available to recipients. The top three categories selected in North America were general “big box” stores, coffee, and exclusively online retailers.

Similarly, across various merchant types in Europe, the majority forecast participation growth in the realm of gift card rewards. Minor exceptions include declines in sunglasses (-6% vs. prior year), beauty (-4% vs. prior year), and clothing/apparel (-4% vs. prior year). Notably, exclusively online retailers maintain their prominence as the most common merchant type for branded gift cards in Europe, sustaining the 2023 rate at 54%. Coffee gift cards and department store cards continue to exhibit growth, securing the second and third positions as the most frequently chosen gift card categories in Europe.

Event gifting continues to grow. A significant 55% of respondents plan to augment their budgets, according to the survey, with only 7% foreseeing a decrease. Third party respondents anticipate the most substantial changes, with a 61% net increase expected in 2024. The top event gifts in North America are brand name merchandise (73%), food and beverage crafted locally (57%), and gift cards (56%)

In 2023, average annual per-person spend on event gifts was $944 in North America and €869 in Europe. North American third parties say they spend significantly more than their corporate counterparts ($1,635 third party vs. $847 corporate). In Europe the corporate program owners spend modestly more than third party agencies (€880 corporate vs. €821 third party).

Europeans also plan to boost their event gifting budgets in 2024, with a slightly higher net percentage increase compared to North America. Specifically, 57% of respondents in Europe plan to enhance budgets, while only 6% intend to decrease them. In contrast to North America, the net increase in budgets in Europe is propelled more by corporate (54% net increase) than by solution providers, (38% net increase). Top European event gifts are nationally recognized brand name merchandise (52%), gift cards (50%), locally relevant goods and crafts (47%).

Meaningfulness is the number one priority in both North America and Europe when selecting an event gift. Customer events, conferences, tradeshows, and internal meetings were the most common meeting types for event gifting in North America and Europe. More North Americans say sponsors do not cover event gifting costs than Europeans (24% North America vs. 9% Europe).

Profit From the “S” of Environmental, Social, Governance (ESG)

Through education, media, business development, advisory services, and outreach, the Enterprise Engagement Alliance supports boards, business analysts, the C-suite, management in finance, marketing, sales, human resources and operations, etc., educators, students and engagement solution providers seeking a competitive advantage by implementing a strategic and systematic approach to stakeholder engagement across the enterprise. Click here for details on all EEA and RRN media services.

1. Professional Education on Stakeholder Management and Total Rewards

- Become part of the EEA as an individual, corporation, or solution provider to gain access to valuable learning, thought leadership, and marketing resources.

- The only education and certification program focusing on Stakeholder Engagement and Human Capital metrics and reporting, featuring seven members-only training videos that provide preparation for certification in Enterprise Engagement.

-

EEA books: Paid EEA participants receive Enterprise Engagement for CEOs: The Little Blue Book for People-

Centric Capitalists, a quick implementation guide for CEOs; Enterprise Engagement: The Roadmap 5th Edition implementation guide; a comprehensive textbook for practitioners, academics, and students, plus four books on theory and implementation from leaders in Stakeholder Management, Finance, Human Capital Management, and Culture.

Centric Capitalists, a quick implementation guide for CEOs; Enterprise Engagement: The Roadmap 5th Edition implementation guide; a comprehensive textbook for practitioners, academics, and students, plus four books on theory and implementation from leaders in Stakeholder Management, Finance, Human Capital Management, and Culture.

- ESM at EnterpriseEngagement.org, EEXAdvisors.com marketplace, ESM e–newsletters, and library.

- RRN at RewardsRecognitionNetwork.com; BrandMediaCoalition.com marketplace, RRN e-newsletters, and library.

- EEA YouTube Channel with over three dozen how-to and insight videos and growing with nearly 100 expert guests.

Strategic Business Development for Stakeholder Management and Total Rewards solution providers, including Integrated blog, social media, and e-newsletter campaigns managed by content marketing experts.

4. Advisory Services for Organizations

Stakeholder Management Business Plans; Human Capital Management, Metrics, and Reporting for organizations, including ISO human capital certifications, and services for solution providers.

5. Outreach in the US and Around the World on Stakeholder Management and Total Rewards

The EEA promotes a strategic approach to people management and total rewards through its e-newsletters, web sites, and social media reaching 20,000 professionals a month and through other activities, such as:

- Association of National Advertisers Brand Engagement 360 Knowledge Center to educate brands and agencies.

- The EEA Engagement widget to promote, track, and measure customers/employee referrals and suggestions that can be connected to any rewards or front-end program management technology.

- The Stakeholder Capitalism free insignia to promote a commitment to better business.

- The BMC Brand Club and transactional storefronts to educate corporate and agency buyers on the IRR market.

- The EME Gold program to educate the top 3% of promotional consultants on selling engagement and rewards services